ETWA 2022 - Day 1

Click on a session title to watch or listen:

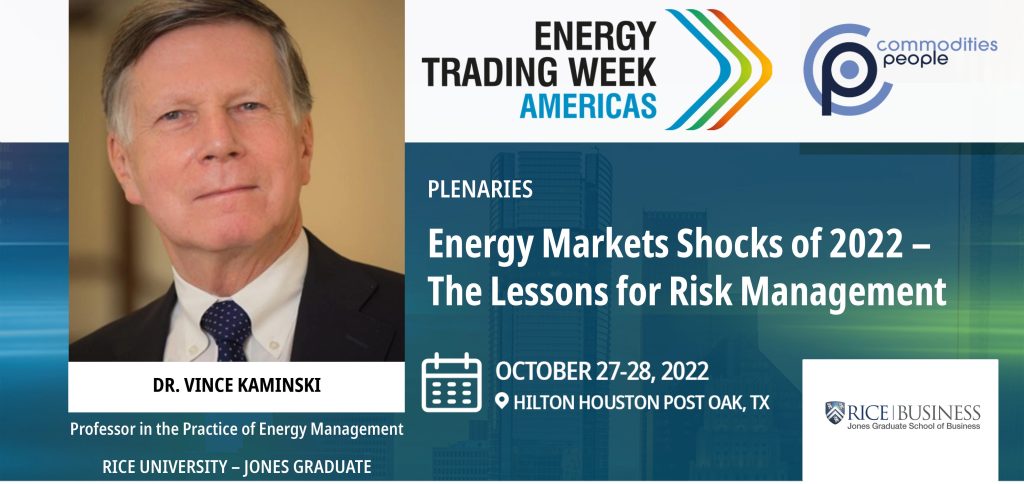

Energy Markets Shocks of 2022 – The Lessons for Risk Management

• The importance of energy to social and economic life

• The importance of energy to social and economic life

• Energy markets as a complex and a tightly coupled system

• The road to hell is paved with good intentions: have the recent reforms made the financial system less stable?

• The road forward: What can be done to stabilize the energy markets?

Dr. Vince Kaminski, Professor in the Practice of Energy Management, Rice University – Jones Graduate School of Business

Executive roundtable: Winter is Coming!

• Managing high price, high volatility market environment

• Domestic infrastructure concerns

• Environmental mandates

• Inflationary concerns

• Staffing issues

• Geopolitics/energy security

Ken Robinson, President, ENGIE Energy Marketing NA

Arun Eamani, President Rivercrest Power Trading, Head of Power Trading, BioUrja Group

Thomas Smith, Chief Risk Officer, NRG Energy

Voluntary carbon markets: From removals to nature based

- Update on GHG protocol review

- Linking crypto with carbon offsets

- Bifurcation of pricing in voluntary markets

- Greenhouse Gas Protocol

Adam Raphaely, Managing Director, Mercuria Energy America

Solid fuels renaissance

- Keeping the lights on

- Critical manufacturing uses

- Role in energy transition

Haroldo Andrade, Trading Manager, Grupo Unimetal

The Energy Evolution & Its Impact on Power Markets

- Four main forces drive the Energy Evolution landscape: political, consumer, investor, and microeconomic. How do these financial and values-based incentives drive the power and renewables markets forward?

- What will the impact of the Inflation Reduction Act be on the power & renewables markets in the coming years? How will it impact power pricing and what and where are the constraints?

Sarp Ozkan, VP COMMERCIAL PRODUCT, ENVERUS

Summer of discontent: A view from the retail front lines

- How is this causing chaos for customers?

- Hedging strategies

- What to expect in the coming heating season?

Mark Stultz, VP Communications, JEA

Crude oil and refined products market

- EU and USA sanctions on Russian oil

- Replacing Russian oil

- High gasoline prices driving policy

- Strategic Petroleum Reserves

- The Oil Price Cap Proposal

- OPEC+ and NOPEC legislation

- Nordstream pipeline

- Replacing Russian natural gas

Andrew Lipow, President, Lipow Oil Associates

Forecasting US Natural Gas production growth

- Efficiencies in fracking vs rigs

- Production and ESG

- Production view, next 18 months

Eric Anderson, Chief Technology Officer, Synmax

Tony Franjie, Natural Gas Analyst, Skylar Capital Management LP

U.S. Natural Gas Outlook: Domestic Balances Vastly Improved, but Will Global Factors Create Chaos This Winter?

- Massive storage injections in late fall dramatically alter winter supply outlook

- After a sluggish summer, production surges above 100 Bcf/d -Freeport’s return and other risks to LNG demand this winter

- How cold is this winter going to be? Depends on who you ask.

Leticia Gonzales, Pricing & Markets Editor, NGI

ESG: Get your priorities straight

- Considerations for prioritizing steps in your ESG program

- What will regulators and banks be looking at first?

- Steps, sub steps and sub-sub-steps: The devil’s in the details

- Are all carbon offsets the same?

- Carbon tracking and carbon offsetting

Moderator: Caroline Gentry, Sr. Director, Environmental Products, ANEW

Jamila Piracci, Managing Director, Potomak Global Partners

Elizabeth Carlson, Chief Sustainability Officer, Tricon International

Richard Williamson, CEO, Gen10

Michael Hinton, Global Head of Energy Portfolio Management, Hitachi Energy

24/7 Renewables: Is it possible?

- Renewable mix

- Demand response

- Transmission constraints

- Storage

Moderator: Caroline Gentry, Sr. Director, Environmental Products, Anew

Terry Embury, VP, Head of Trading and Market Operations, AES Clean Energy

Jazib Hasan, Managing Director, EIG Global Energy Partners

Seenu Kaliamurthy, Managing Director of Power Solutions, Enuit

Sean Dunderdale, Business Development Analyst – Gas and Low Carbon Energy, BP

Brock Mosovsky, Co-Founder and VP Analytics cQuant.io_

Commercialization of Carbon Capture

- Projects

- Technologies

- Incentives

Moderator: Howard Walper, CEO, Americas, Commodities People

Upendra Prasad, Facilities Engineer, Marathon Oil

Mark Lay, Founder and Managing Director, Oso Negro, LLC

Sarp Ozkan, VP COMMERCIAL PRODUCT, ENVERUS

Navigating high prices and volatility

• Trading groups are reaching their VaR limits and needing more money to hedge

• Trading groups are reaching their VaR limits and needing more money to hedge

• Managing higher margin requirements

• How will this market environment advantage large, integrated energy companies (vs. smaller trading firms)?

• How are traditional stress testing methods holding up in this business environment?

Moderator: Mike Prokop, Managing Director, The Alliance Risk Group

Sid Jacobson, Vice President of Risk Management, Cleco

Ossie Okeke, Managing Partner, Vennsmith

Sean Britton, Head of Risk & Compliance, Musket

Mark Friedman, Consultant, Motiva

Issues impacting credit risk and structuring

• How much residual risk is “out there” and how long will it be an issue for the industry.

• Macro drivers of credit issues: What economic and geopolitical issues should credit risk managers be watching that could impact credit in the coming months?

• New forms of collateral: Surety bonds are gaining ground as instruments of collateral, over more traditional instruments.

Moderator: Mike Prokop, Managing Director, The Alliance Risk Group

Pat McKinnon, First VP – Energy Markets and Digital Distribution, First VP – Energy Markets and Digital Distribution, Navitas Assurance Partners and CCRO Group Leader

Sayari Riabi Lamia, Head of Documentary Operations, Guarantees

and Counter-Guarantees, Attijaribank, Tunise

Joe Graham, Structured Origination, Six One Commodities

William H. “Bull” Flaherty II, Managing Director, Bridgelink Commodities, LLC

CCRO Risk leaders in the spotlight

• Why a “seat at the table” is more important than ever in a high price, high volatility environment

• Updates on CCRO working groups

Bob Anderson, Executive Director, CCRO

Interoperability

• Manage communications between various applications and system

• Standardizing back office processes while allowing for innovation on commercial system

• Establishing cross industry standards

Moderator: Patrick Reames, Founder and Managing Director, Commodity Technology Advisory

Chris Sass, Co-Founder, CRO, CMO, Fidectus

Jay Bhatty, CEO, NatGasHub.com

Sameer Soleja, CEO and Founder, Molecule Software

John Beaty, General Manager, Avalara

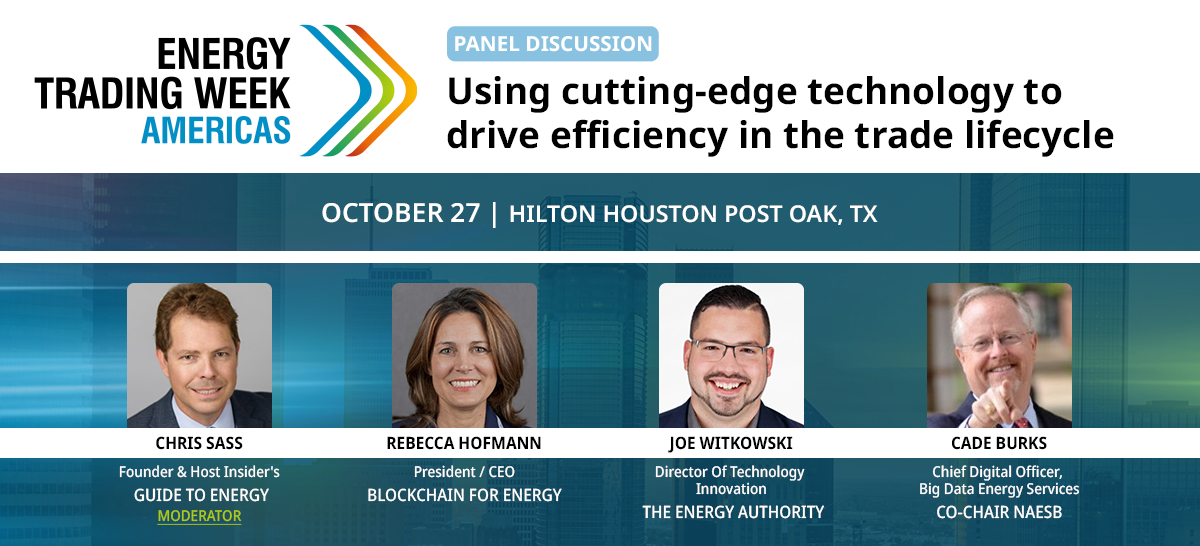

Using cutting-edge technology to drive efficiency in the trade lifecycle

Hear how leading companies and industry associations are using technologies like blockchain and AI/Machine Learning to drive efficiencies in the trade life-cycle (and other areas).

• How an industry standards organization is using DLT to streamline natural gas settlements

• Learnings from the upstream and other parts of the industry

• AI use cases

Moderator: Chris Sass, Founder & Host, Insider’s Guide to Energy

Rebecca Hofmann, President / CEO, Blockchain For Energy

Joe Witkowski, Director Of Technology Innovation at The Energy Authority

Cade Burks, Chief Digital Officer, Big Data Energy Services, Co-Chair NAESB

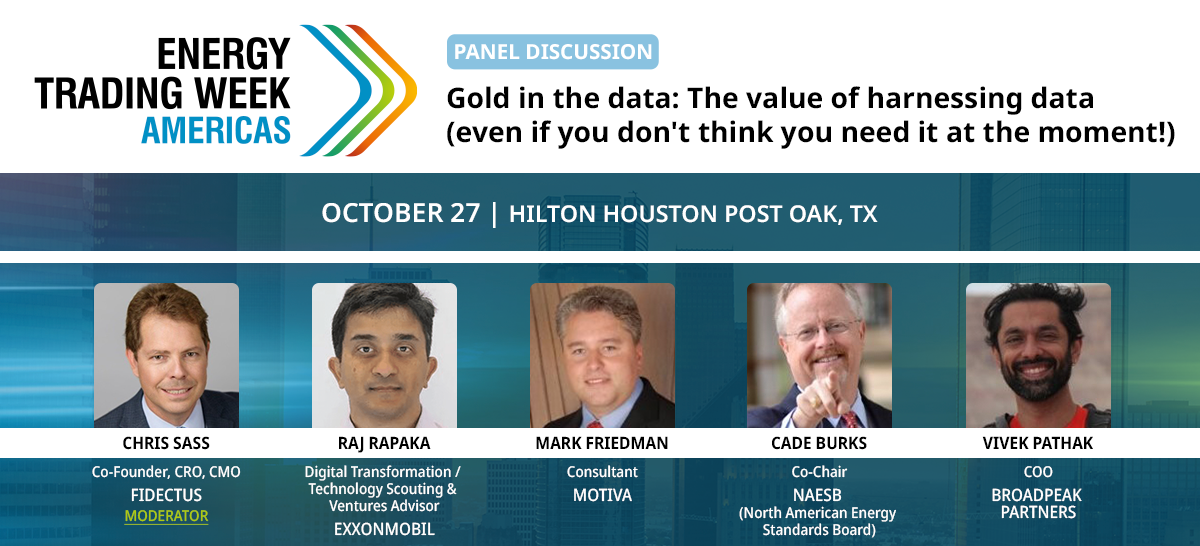

Gold in the data: The value of harnessing data

• Identifying and making sense of data sources

• Data as a tool in disaster mitigation

• Gaining customer/sales insight through data

• Data governance

• Good data vs. big data

Moderator: Chris Sass, Founder & Host, Insider’s Guide to Energy

Raj Rapaka, Digital Transformation / Technology Scouting & Ventures Advisor,

ExxonMobil

Mark Friedman, Consultant, Motiva

Cade Burks, Vice Chair, NAESB (North American Energy Standards Board)

Vivek Pathak, COO, Broadpeak Partners

Moving from long term contracts to commoditization (and back again?)

• How much has the geopolitical situation accelerated this change and what does the mix of long term vs. spot deals look like today?

• Issues surrounding LNG contracts

• Is US price indexing an enabler or a deterrent?

• Risks around JKM, Henry Hub indexation

• Competition for cargoes

Moderator: Jason Feer, Head of Business Intelligence, Poten & Partners

Keith M. Sappenfield, II, Manager, Regulatory Project Strategy for Cheniere Energy, Inc. Also, member of NAESB Board of Directors, and Chair of Wholesale Gas Quadrants Contracts Subcommittee

Eric McGuire, Director – Short-Term Analytics and Commodity Research, Wood Mackenzie

Chris Ferrell, Associate Director of Global Engagement & Intelligence, Gen Fuels, LNG and Energy Transition, S&P Global/Platts

Victor Ureta, Director Risk & Structuring, Sempra Infrastructure

ETWA 2022 - Day 2

Click on a session title to watch or listen:

Developing the hydrogen market

Creating a successful physical commodity model and infrastructure requires a forward-looking industry, a proven transaction platform, and a reliable data capture and reporting organization.

Learn how The Center for Houston’s Future, Xpansiv, and S&P Global are working together to help create the Houston hydrogen market; the next big step forward in the effort to make a sustainable energy transition.

Brett Perlman, CEO, Center For Houston’s Future

Bob Shults, Head of XRegistries, Xpansiv

Santiago Canel Soria, Hydrogen Pricing Analyst, S&P Global

Mike Prokop, Managing Director, Digital Transformation and Sustainability, The Alliance Risk Group, LLC

Updates on SEC climate reporting regulations

Jamila Pirraci, Managing Director, Patomak Global

Risk Management for the Energy Transition: Renewables, Batteries, and Carbon

As our energy supply continues to transition from centralized fossil-fueled power plants to more distributed intermittent generation resources, best practices in risk management are evolving to keep pace. The prevalence of renewable power purchase agreements (PPAs) has exposed a broader range of organizations than ever before to the extreme financial uncertainty of wholesale electricity markets; it’s no longer just power generators and load serving entities that must grapple with these challenges.

This presentation will discuss:

• The challenges and risks that many organizations face as a result of the renewable energy transition

• The strategies for identifying and managing financial risk as well as tracking the net position of a variety of portfolio level attributes (e.g., cash flow, MWh, renewable energy certificates, CO2, etc.)

• The complexity involved in the renewable energy transition, how particular organizations will be affected, and what can be done to mitigate uncertain.

Brock Mosovsky, Co-Founder and VP, Analytics, cQuant.io

Duelling regimes: Comparing trading compliance programme (program) needs in the US and Europe

• Trade oversight (market abuse etc)

• Dealing with exchanges and venues

• Transaction reporting

• Carbon

Thomas Lord, Advisory Board Member, JP Morgan Center for Commodities

Trade Surveillance and Compliance

• Keeping up with technology – Impact of recent CFTC enforcements

• Challenges of managing compliance in a work-from-home environment

• SEC and FERC initiatives

Moderator: Howard Walper, CEO, Americas, Commodities People

Matthew Moore, Associate Director, Risk Surveillance, Macquarie Group

Swati Sachdev, Senior Compliance Advisor, Hartree Partners

Cybersecurity: More important than ever

• Geopolitical risk

• More systems, more risk

• Vulnerability checks

• Training your team

• Response preparedness

Moderator: Howard Walper, CEO, Americas, Commodities People

Jacquelyn Hallmark, Manager, IT Cyber and Information Security, Just Energy

Paul Kaisharis, SVP Software Engineering, Molecule Software

Implementation journeys

• How have implementations been impacted by the pandemic?

• What best practices are evolving for implementation of ETRM, BI and other analytics platforms?

Moderator: Patrick Reames, Founder & Managing Director, Commodity Technology Advisor

Richard Williamson, CEO, Gen10

Richard Reedstrom, Implementation & Customer Success Analyst, Molecule Software

Sean Britton, Head of Risk & Compliance, Musket

Algorithmic trading

Luis Molina, Head of Market Risk, Pilot

LNG Shipping Markets: Wildcards and Opportunities

• High LNG Prices: What is their effect on LNG shipping demand and spot rates?

• Impacts of the Russia/Ukraine conflict. What happens if the majority of U.S. LNG exports continue to go to Europe?

• How are high newbuild prices impacting the market?

Jefferson Clarke, M&A Advisory / Project Development, Poten & Partners

Risk on the Waves: Managing trading risk in LNG markets

Eric McGuire, Director – Short-Term Analytics and Commodity Research, Wood Mackenzie

• Challenges that Risk Officers face in the LNG market

• Robust valuation

• Effective hedging

• Measured risk capital

• Managed cashflow risks

Eric Twombly, Credit Risk Manager, Golden Pass LNG

Moderator: Chris Sass, CO-FOUNDER, CRO, CMO, FIDECTUS

Lara Cottingham, CHIEF OF STAFF, GREENTOWN LABS

Alex DeStefano, SR. TERM TRADING AND STRUCTURING, ENEL GROUP

Kamil Siddiqi, TECHNICAL MANAGER, AKER OFFSHORE WIND

Josephine Evans, PHR, HUMAN RESOURCES DIRECTOR AT CIMA ENERGY, LP

Moderator: Chris Sass, CO-FOUNDER, CRO, CMO, FIDECTUS

Kym Springer, PRESIDENT, TEAM BUILDERS

Taya Berry, HR BUSINESS PARTNER, MIDSTREAM AT PHILLIPS 66

Howard Walper, CEO AMERICAS, COMMODITIES PEOPLE

Tom Edwards, President at CIMA ENERGY, LTD